The share of customers who indicated they’re both “somewhat comfortable” or “very comfortable” with their diets rose from 81% in January 2024 to 87% final month, in line with the April 2024 Client Meals Insights Report. This stunning discovering follows in depth media consideration dedicated to points like meals inflation in latest months, the report’s authors famous.

Nevertheless, the CFI Report additionally discovered that city customers are extra seemingly than rural customers to be pleased with their diets, which is supported by the authors’ findings on diverging meals insecurity charges. The survey-based report out of Purdue College’s Middle for Meals Demand Evaluation and Sustainability assesses meals spending, client satisfaction and values, assist of agricultural and meals insurance policies, and belief in info sources. Purdue consultants performed and evaluated the survey, which included 1,200 customers throughout the US.

“Over the previous 28 months, we’ve measured meals insecurity amongst rural households that’s almost twice the speed of city households, 22% vs. 14%, respectively,” mentioned the report’s lead writer, Joseph Balagtas, professor of agricultural economics at Purdue and CFDAS director. “Poverty charges are larger in rural areas, and one consequence of poverty is that it’s more durable to afford to place meals on the desk.”

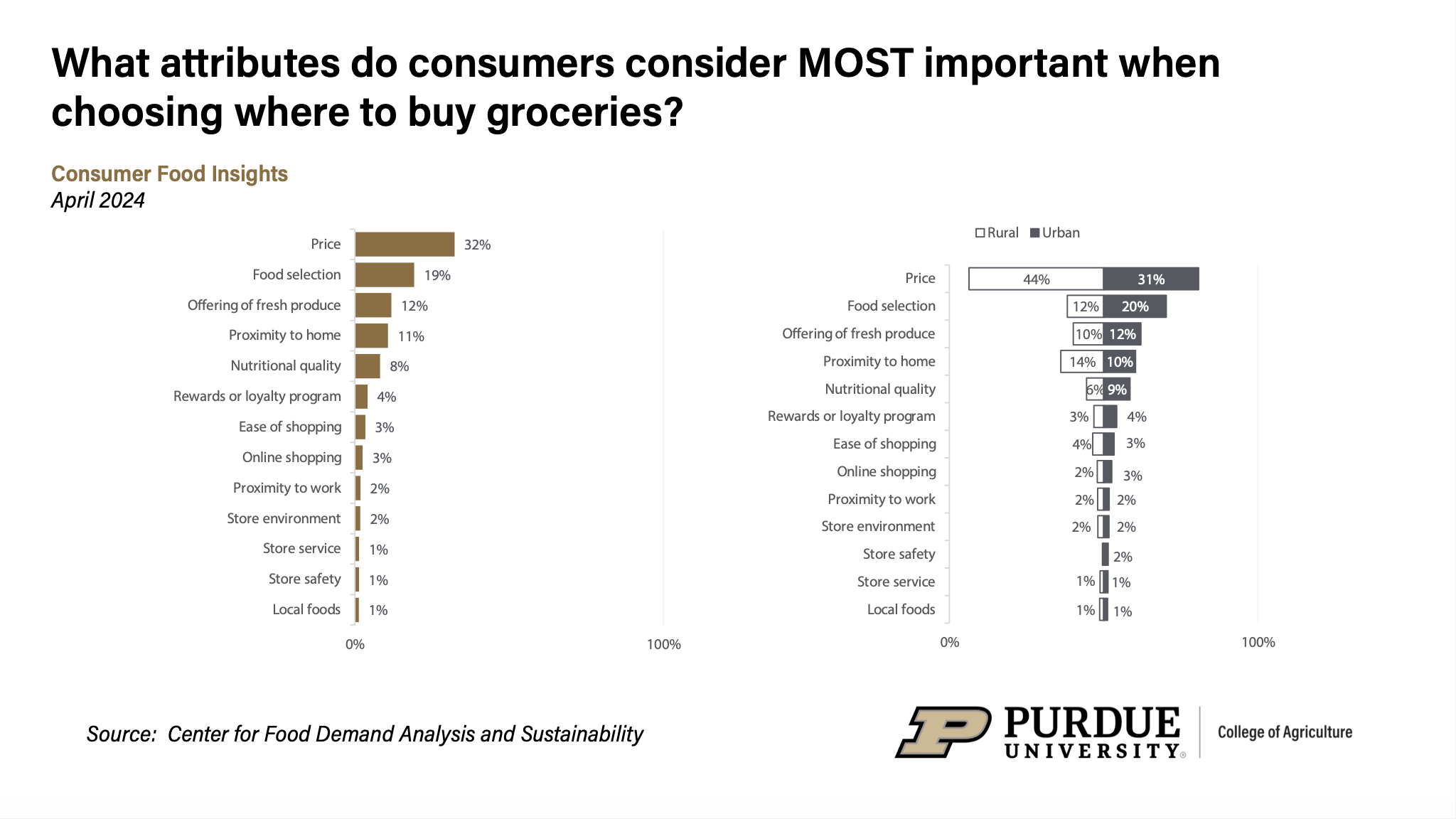

What attributes do customers contemplate vital when selecting the place to purchase groceries?

The April survey included questions associated to customers’ retailer decisions. Particularly, it gauged what sorts of meals shops customers have obtainable to them and which of those obtainable shops they shopped at within the final month.

The survey coated what a typical buying journey is like for customers and which retailer attributes are vital to them when deciding the place to buy. Additionally included was how responses differ between rural and concrete customers. The report categorised households as rural or city utilizing the USDA Financial Analysis Service’s rural-urban commuting space codes. All 28 months of CFI knowledge are summarized within the new report.

Essentially the most generally accessible retailer codecs are conventional grocery shops (accessible to 82% of the pattern) and superstores (82%), adopted by greenback shops (66%), membership shops (57%) and comfort shops (51%). Accessibility differs alongside the rural-urban divide. Grocery shops are barely much less accessible for the agricultural inhabitants than the city inhabitants (76% vs. 83%), whereas superstores (89% vs. 82%) and greenback shops (78% vs. 64%) are extra accessible for the agricultural inhabitants. The shop format with the largest distinction in accessibility is membership shops. “Solely 30% of the agricultural inhabitants in comparison with 60% of the city inhabitants inform us they’ve entry to membership shops,” Balagtas mentioned.

The researchers additionally discover some rural-urban variations in retailer selection. “Amongst individuals with entry to grocery shops, rural persons are barely much less prone to store at grocery shops and barely extra prone to store at superstores,” Balagtas mentioned.

What attributes do customers contemplate most vital when selecting the place to purchase groceries?

Additional, about 60% of rural households with entry to a greenback or low cost retailer shopped at one within the final 30 days. This discovering aligns with 2021 market analysis of the USDA Financial Analysis Service that highlights dollar-store market development in rural U.S. nonmetro areas.

The CFDAS researchers additionally tried to gauge the significance of various retailer attributes in respondents’ decision-making course of. Following earlier literature concerning retailer selection, they requested customers to fee the significance of key objects on a scale from 1, or by no means vital, to five, or crucial.

“The highest-rated attributes have been ‘meals choice,’ ‘providing of recent produce’ and ‘value,’ which obtained common scores of 4.6, 4.6 and 4.5 out of 5, respectively,” mentioned Elijah Bryant, a survey analysis analyst at CFDAS and co-author of the report.

“Out of the listed attributes, ‘on-line buying’ obtained the bottom common score at 3.1. Nevertheless, it ought to be famous that this doesn’t suggest that on-line delivery is just not vital to customers. It simply didn’t rating as excessive on the dimensions,” Bryant mentioned.

The CFDAS researchers additional requested customers to select the attribute they contemplate most vital when selecting the place to purchase groceries. One-third of customers chosen “value” as crucial attribute, adopted by “meals choice” (19%) and “providing of recent produce” (12%).

“Many customers look like cost-focused when selecting the place to buy, particularly rural customers, about half of whom picked ‘value’ as crucial attribute when selecting the place to buy,” Bryant mentioned. “Inflation over the previous few years might have extra customers aware of the price of their groceries.”

Common weekly meals spending rose to $202 final month, up 10% from April 2023 and 17% from April 2022. Rural households spend much less every week on meals away from dwelling than city households. This seemingly resulted from rural residents consuming fewer meals at eating places, Bryant famous.

The patron value index measure of meals inflation remained unchanged from final month at 2.2%. That is the primary time the index has not decreased because it peaked at 11.3% in August 2022.

As for client beliefs and belief, the survey confirmed that city customers usually tend to view agriculture as a big contributor to local weather change than are rural People. Lots of the latter depend on agriculture as an financial driver.

“Equally, extra city customers, 50%, consider that consuming much less meat is best for the surroundings than rural customers, 38%,” Bryant mentioned. Even so, the researchers see few variations within the stage of belief in several sources of food-related info.

“Nevertheless, the USDA, which works carefully with the agriculture trade and rural economies, scores larger on the belief index amongst rural customers in comparison with city customers,” Bryant added.

The Middle for Meals Demand Evaluation and Sustainability is a part of Purdue’s Subsequent Strikes in agriculture and meals methods and makes use of progressive knowledge evaluation shared by user-friendly platforms to enhance the meals system. Along with the Client Meals Insights Report, the middle affords a portfolio of on-line dashboards.