Greater than 80% of customers understand that meals costs have elevated a bit or loads over the past 12 months, based on the Might 2024 Client Meals Insights Report (CFI).

The survey-based report out of Purdue College’s Heart for Meals Demand Evaluation and Sustainability assesses meals spending, client satisfaction and values, help of agricultural and meals insurance policies and belief in data sources. Purdue specialists performed and evaluated the survey, which included 1,200 customers throughout the U.S.

The Bureau of Labor Statistics’ client value index measure of meals inflation exhibits a 12-month improve in meals costs of two.2%, down from 4.4% a yr in the past. “Whereas meals inflation has slowed in 2024, customers are feeling the cumulative impact of the excessive inflation we’ve skilled,” mentioned the report’s lead creator, Joseph Balagtas, professor of agricultural economics at Purdue and director of CFDAS.

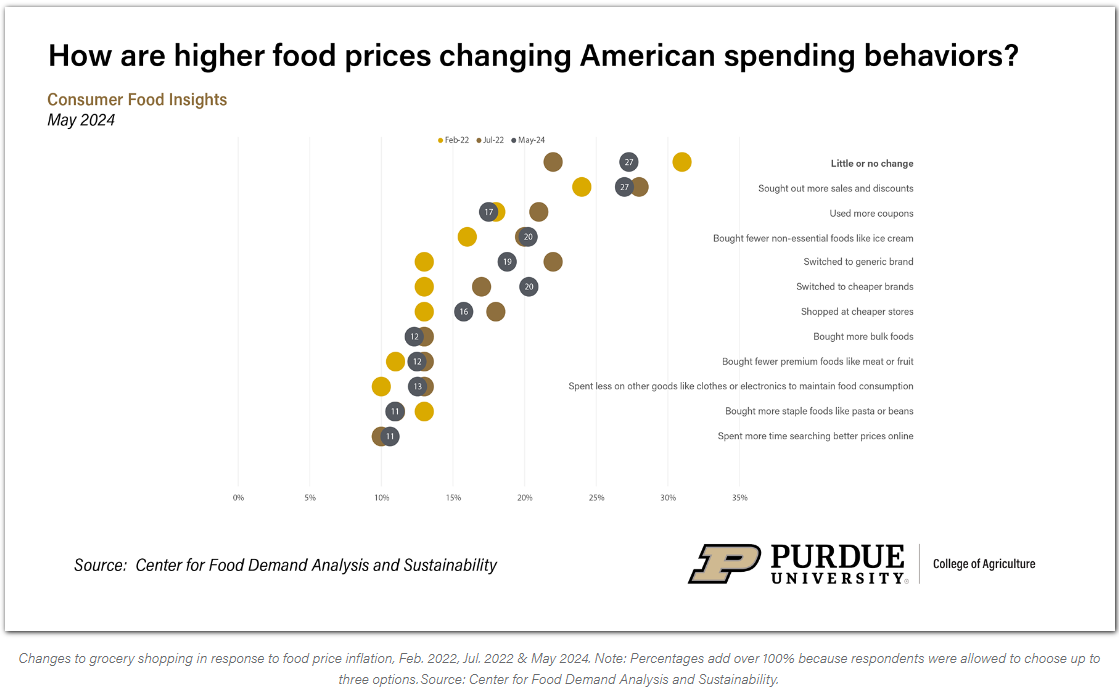

The Might CFI survey requested customers to report their experiences and responses to rising meals costs over the past 12 months. The survey included a query requested beforehand in February and July 2022, seeing how customers have tailored their grocery procuring in response to meals value inflation.

The researchers discovered that the commonest procuring variations to meals inflation are searching for out gross sales and reductions, switching to cheaper and generic manufacturers, and shopping for fewer nonessential meals like ice cream.

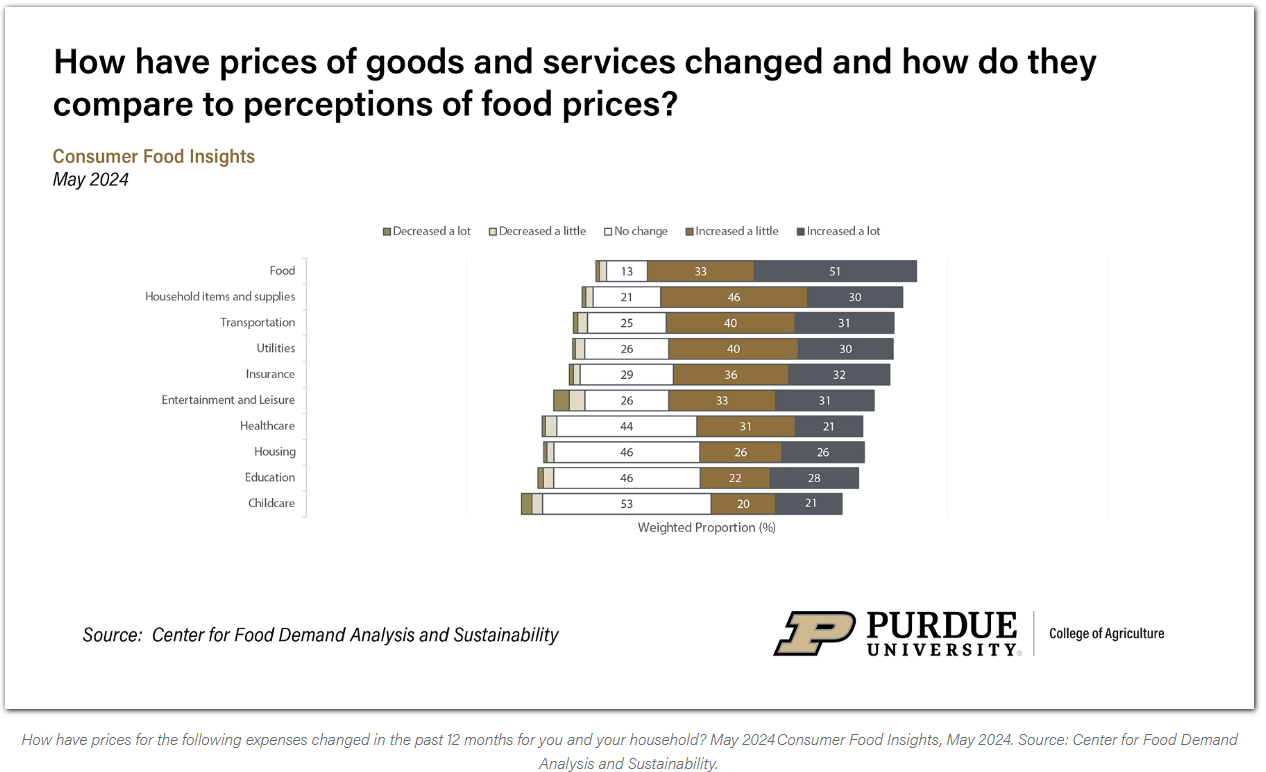

“We additionally needed to grasp how perceived adjustments in meals costs examine with perceived value adjustments for different widespread family bills,” Balagtas mentioned. “Customers had been extra prone to report value will increase for meals than for every other good or service within the economic system.”

Equally, when requested which items and providers noticed the biggest year-over-year value improve, 56% of customers chosen “meals,” regardless of official inflation information that present costs of insurance coverage, housing and youngster care have risen sooner than costs for meals previously yr. “It’s doable the excessive frequency with which we store for meals might make increased meals costs extra salient to customers. Media consideration to meals might additionally play a job,” Balagtas mentioned.

The Might survey revisited generational variations analyzed in previous studies by categorizing customers into Gen Z (born after 1996), millennials (born 1981-1996), Gen X (born 1965-1980), and boomer-plus (born earlier than 1965).

“One space the place we see greater generational variations when asking about current client experiences is the supply of funding that buyers reported counting on to buy meals,”

Balagtas mentioned. “Round 37% of Gen Z and millennial customers report drawing on financial savings or going into debt to finance their meals purchases over the previous yr in comparison with 28% of Gen X and solely 13% of boomer-plus customers. It’s regarding to see over a 3rd of younger adults needing to stretch their funds to afford meals.”

Meals insecurity is highest amongst Gen Z adults, with round one-third of customers from this group additionally reporting having bother accessing high quality meals. That is a lot increased than the speed of meals insecurity amongst older Gen X (13%), and boomer-plus (5%) customers.

“Extra analysis is required, however these outcomes are doubtless pushed partially by a stage-of-life impact, as revenue and wealth improve are drivers of meals safety and have a tendency to extend with age,” Balagtas mentioned.

The April client value index measure of meals value inflation — the newest obtainable — remained unchanged from March at 2.2%. The inflation charge appears to have stabilized, having stayed round 2.2% for the final three months, famous Elijah Bryant, a survey analysis analyst at CFDAS and co-author of the report.

“In response to the middle’s information, client estimates of meals inflation over the previous yr of 6.2% and expectations for the approaching yr of three.6% proceed to stay increased than the CPI estimate,” Bryant mentioned. This implies that client experiences with meals costs have been totally different than the official measurement.

“Customers’ inflation estimates proceed to hover round 6%, displaying that the dramatic improve in meals inflation in earlier years should be affecting client meals value sentiment. Nonetheless, customers have been constantly extra optimistic about future meals costs relative to their inflation estimates over the previous 12 months,” Bryant mentioned.

Customers are requested to allocate 100 factors among the many six attributes — style, affordability, vitamin, availability, environmental influence and social accountability — based mostly on the significance of every of their grocery buying selections. Although CFDAS started measuring meals values on a quarterly foundation in January 2024, the researchers have but to watch important adjustments within the significance stage of those attributes.

“Style, affordability and vitamin proceed to be closely thought-about by customers when making a buying resolution on the grocery retailer, whereas environmental influence and social accountability are of decrease significance,” Bryant mentioned. “People’ values have confirmed to be pretty constant regardless of adjustments to the financial panorama over the previous couple of years.”

The survey outcomes present generational variations in meals values, too, between the youthful Gen Z and millennial teams and the oldest boomer-plus group. Youthful generations place extra worth on the environmental and social accountability of their meals when selecting what to purchase. Older customers are extra involved about style.

The frequency of sure procuring and consuming habits additionally differs throughout age teams. As an illustration, youthful customers are extra doubtless to decide on nonconventional meals in comparison with older customers.

“We see this with natural meals, grass-fed beef, cage-free eggs and plant-based proteins,” Bryant mentioned. Nonetheless, all customers no matter age report checking meals date labels usually.

“We additionally observe older customers report consuming unwashed produce, uncooked dough and uncommon meat much less ceaselessly than youthful customers,” he mentioned. This aligns with variations seen in danger attitudes amongst customers of various ages. “Younger adults are extra keen to take dangers with their meals than older adults,” Bryant mentioned.