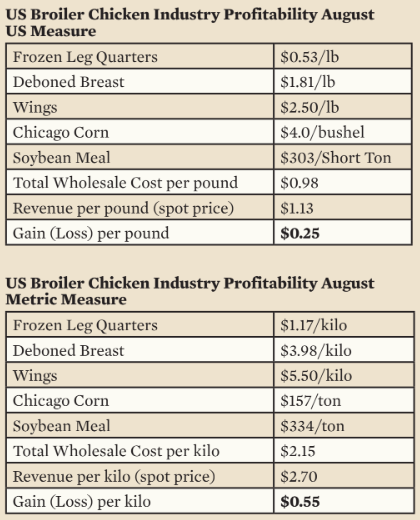

Aviagen Broiler Economics sequence

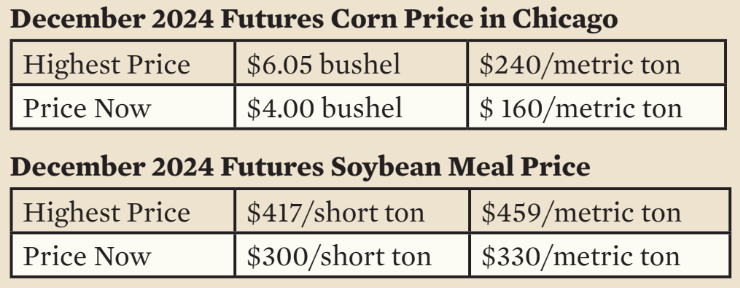

Grain costs proceed to fall. A big harvest this 12 months within the US of corn and soybeans mixed with continued progress in manufacturing in South America implies that poultry producers worldwide are more likely to proceed having fun with low grain costs. Low grain costs might nicely final for one more 12 months. Nonetheless, it’s necessary to do not forget that bear markets finally finish so get pleasure from this one whereas it lasts.

The benchmark value of corn in Chicago is now $4 per bushel ($160 per metric ton) and is more likely to keep low for the remainder of the 12 months as a result of big shares of unpriced outdated crop corn on US farms should be bought within the subsequent two months to make room for the approaching ample harvest. Soybean meal can also be a cut price as a result of return of manufacturing in Argentina this 12 months and the continued progress of complete manufacturing in South America.

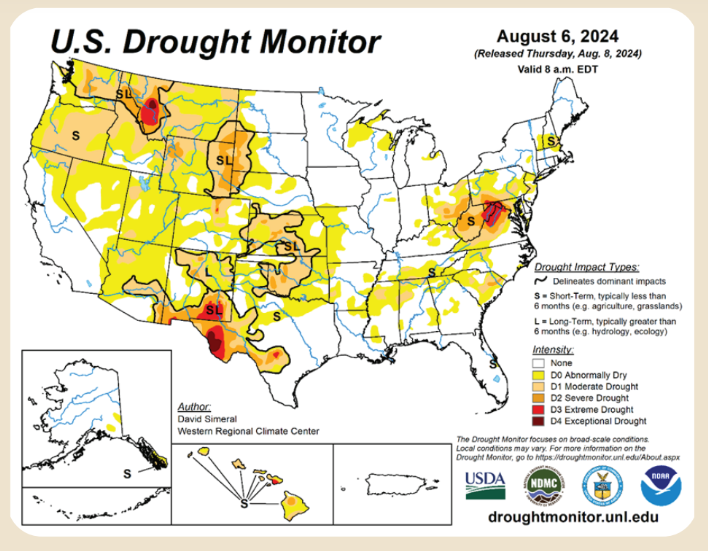

Costs are unlikely to reverse course within the brief time period. Because the US drought monitor beneath exhibits, the Corn Belt is in glorious form aside from a small space on the intense japanese edge. Total, in South America and the remainder of the world, situations are additionally favorable.

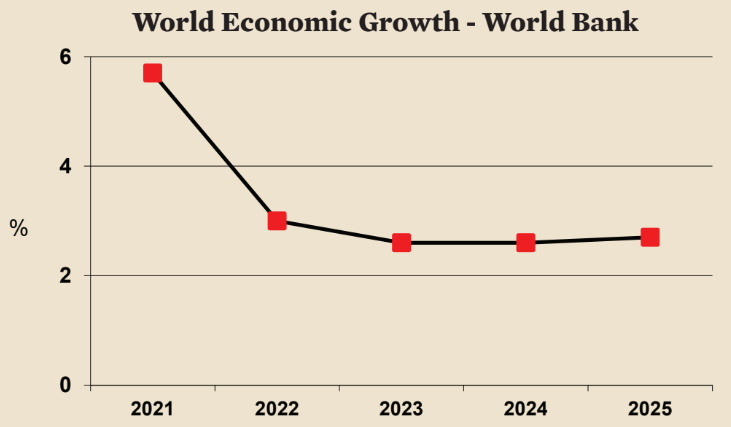

How lengthy will the bear market in grain backside final? It may final via crop 12 months 2025-2026 because the world economic system continues to be sluggish and provides stay ample. The World

Financial institution expects that the half decade of 2020 to 2025 can have the slowest world financial progress in 30 years. Nonetheless, with costs now beneath the price of manufacturing in lots of circumstances, increased costs are inevitable within the not too distant future.

Corn

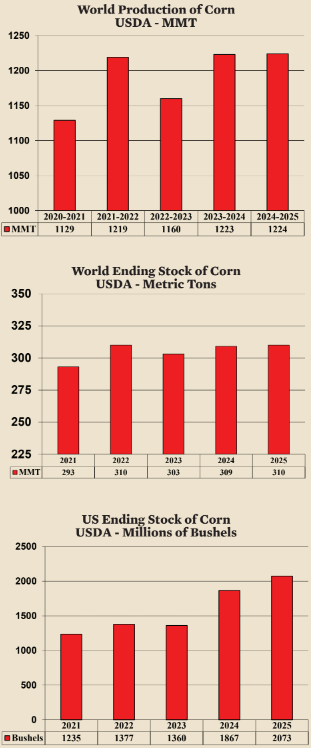

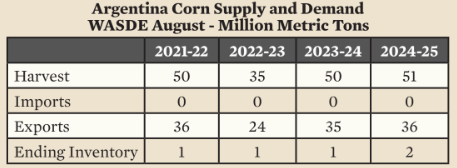

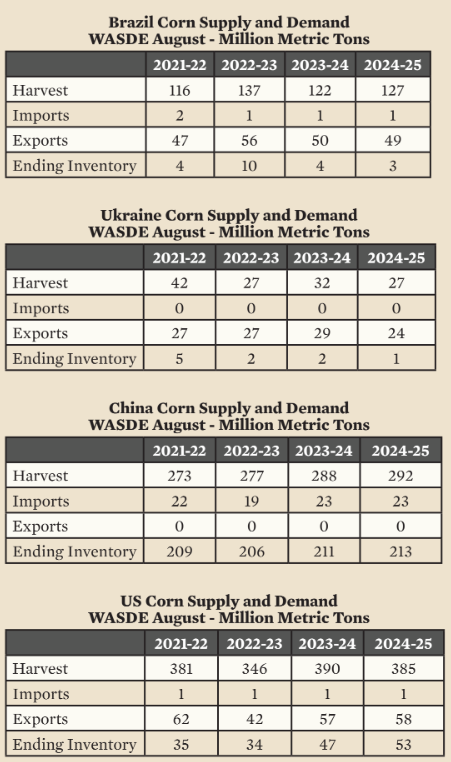

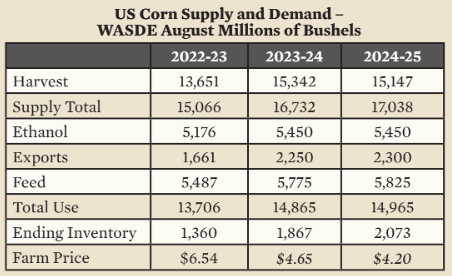

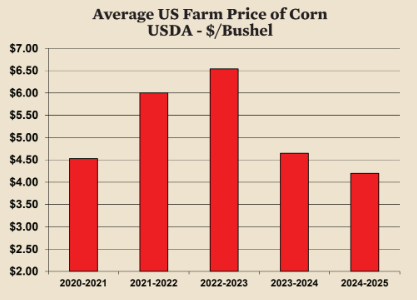

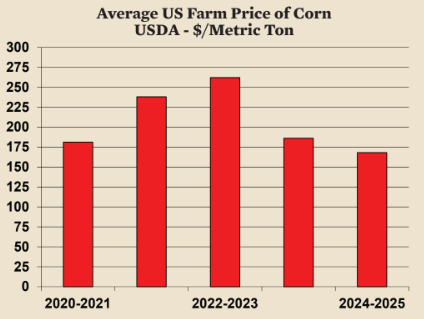

The newest WASDE report initiatives that world corn manufacturing will proceed to be ample in crop 12 months 2024-2025. Two crop years of upper manufacturing and better ending stock resulted in decrease costs. The typical farm value within the US final crop 12 months was $6.54 per bushel ($262 per metric ton). The common this crop 12 months will find yourself lower than $5.00 ($200 per metric ton) and is more likely to be even decrease subsequent crop 12 months. An common value of $4.20 ($166 per metric ton) is projected by the USDA for crop 12 months 2024-2025 which begins on the finish of this month.

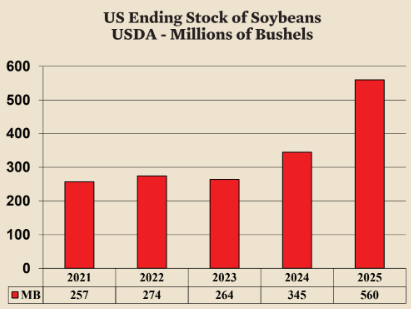

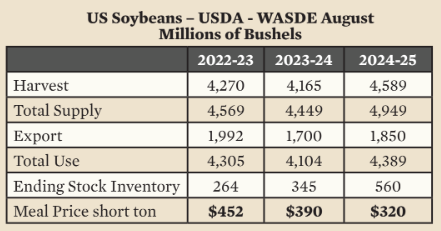

Soybeans

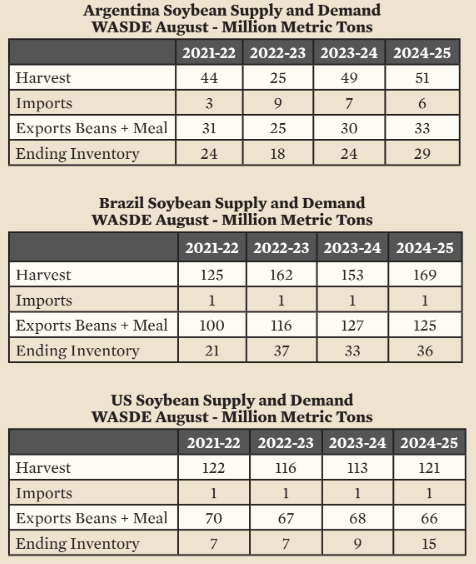

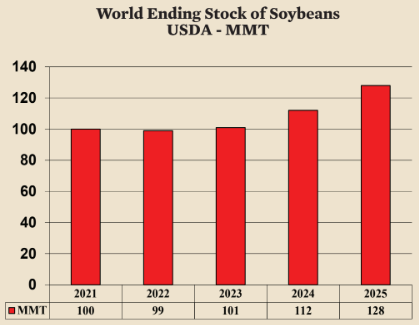

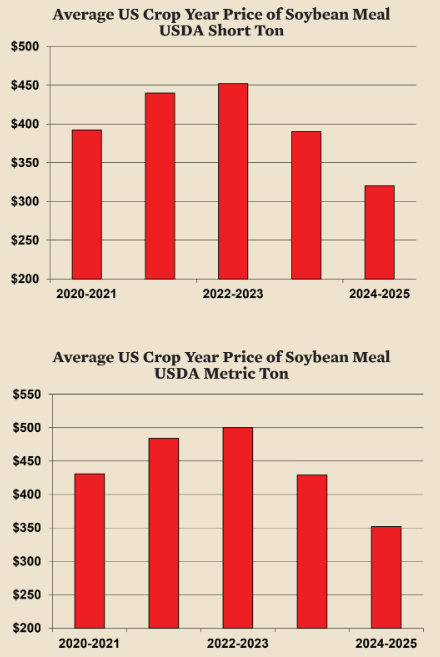

Manufacturing continues to extend quickly in South America. The large potential of Brazil to extend soybean manufacturing mixed with the manufacturing of Argentina and Paraguay leads to South America now representing 55% of world manufacturing. Continued rising manufacturing in South America and an excellent harvest within the US implies that the US benchmark value of soybean meal is projected to common solely $320 ($352 per metric ton) within the subsequent crop 12 months which begins on the finish of this month.

World and US ending shares will probably be increased on the finish of this crop 12 months and presumably subsequent crop 12 months as nicely. Larger ending inventories, in fact, are more likely to result in decrease costs.

Rooster business

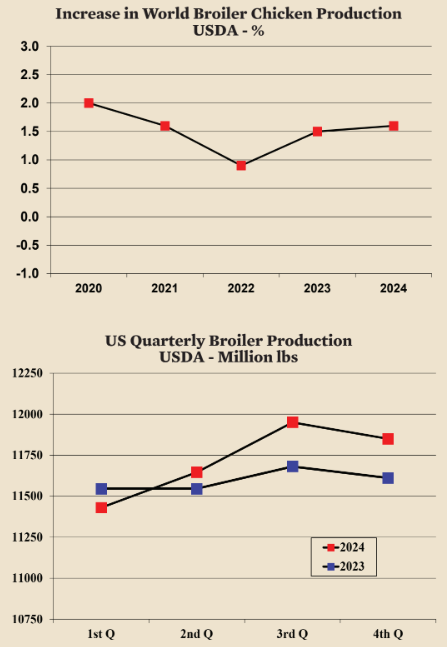

Gradual progress on this planet economic system not too long ago is mirrored in the gradual progress of world hen manufacturing. World hen manufacturing progress averaged simply 1.5% not too long ago. It’s possible that progress will speed up beginning in 2025 and rise to a mean of 2% for the final half of the last decade.

Low costs within the US in 2023 led to a rise in manufacturing of solely 0.4% final 12 months. For 2024, the USDA predicts progress will improve to 1.1% with a lot of the progress within the second half of the 12 months.

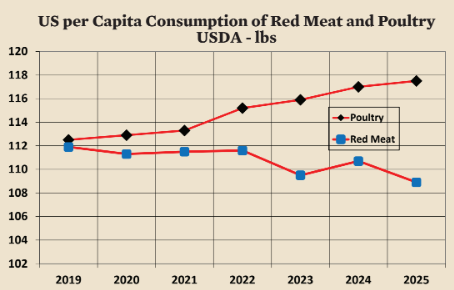

Poultry per capita consumption within the US continues to take market share from purple meat. Between 2021 and 2025, purple meat per capita consumption fell by 3 kilos (1.4 kilos) whereas poultry consumption rose by 5 kilos (2.3 kilos). Complete meat consumption is comparatively steady.

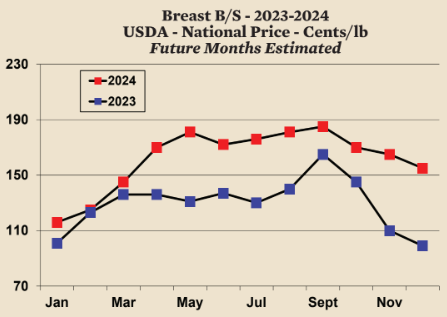

Deboned Breast

The spot costs of deboned breast within the US rose surprisingly quick within the first 5 months of 2024, helped by excessive costs for competing meats. As well as, a comparatively strong US economic system with low unemployment helped assist the value. For the total 12 months the common value of deboned breast is more likely to be considerably increased than final 12 months.

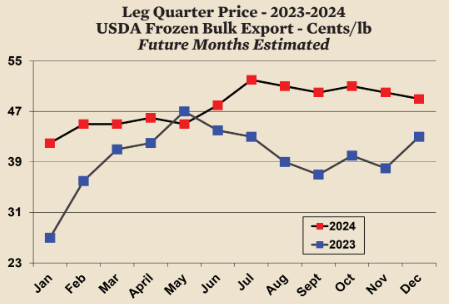

Frozen Leg Quarters for Export

Spot costs for frozen leg quarters are barely increased than final 12 months regardless of a discount within the quantity of exports. Commerce points and a comparatively sturdy greenback are decreasing the potential quantity of exports.

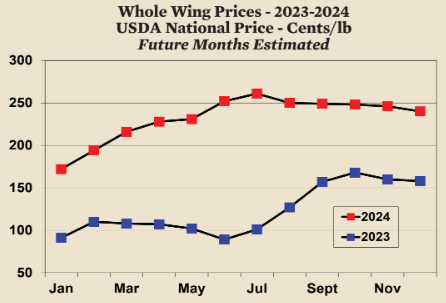

Wings

Wing costs are remarkably excessive. The worth is now double the value final 12 months presently. Wing costs could be anticipated to stay excessive as demand seems to be insatiable.

As a result of agency demand for hen and low value of grain, hen manufacturing within the US is at the moment worthwhile when calculated utilizing spot costs, and is more likely to proceed to be worthwhile all year long.