Spain is likely one of the main European international locations in poultry manufacturing and commerce. In 2020, it ranked in fourth place in poultry meat manufacturing and in third place in egg manufacturing. Over the previous decade, it additionally turned one of many main egg and poultry meat exporting international locations. In two papers, the dynamics and patterns of the 2 sectors can be analysed, protecting the last decade between 2010 and 2020.

Hans-Wilhelm Windhorst – The creator is Professor emeritus on the College of Vechta and visiting Professor on the College of Veterinary Drugs, Hannover, Germany

The position of the Spanish egg trade in home agriculture and within the EU

Egg manufacturing performs an essential position within the Spanish poultry trade and in agriculture (Desk 1). A more in-depth take a look at the event between 2010 and 2020 reveals that in direction of the tip of the previous decade, the contribution to complete animal manufacturing and agriculture decreased.  One motive for the declining worth of egg manufacturing is the quick development of the swine trade, which in 2020 reached a share of 42.8% in animal manufacturing and of 16.4% in complete agriculture; a second, the impacts of the Covid-19 pandemic. The sturdy fluctuation can be as a result of mandatory transformation of housing techniques due to the banning of typical cages within the EU from 2012 on.

One motive for the declining worth of egg manufacturing is the quick development of the swine trade, which in 2020 reached a share of 42.8% in animal manufacturing and of 16.4% in complete agriculture; a second, the impacts of the Covid-19 pandemic. The sturdy fluctuation can be as a result of mandatory transformation of housing techniques due to the banning of typical cages within the EU from 2012 on.

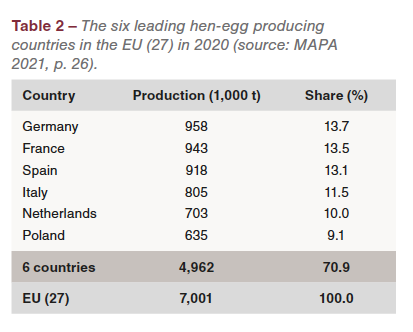

In 2020, Spain ranked in third place behind Germany and France in egg manufacturing with a share of 13.1% within the EU (27) manufacturing quantity (Desk 2). In a later a part of the paper, the extraordinary dynamics since 2010 can be documented.

In 2020, Spain ranked in third place behind Germany and France in egg manufacturing with a share of 13.1% within the EU (27) manufacturing quantity (Desk 2). In a later a part of the paper, the extraordinary dynamics since 2010 can be documented.

Appreciable fluctuation within the laying hen stock and in housing techniques

As in all EU member international locations, the banning of typical cages from 2012 on brought about appreciable fluctuations within the laying hen stock and within the housing techniques for laying hens additionally in Spain.

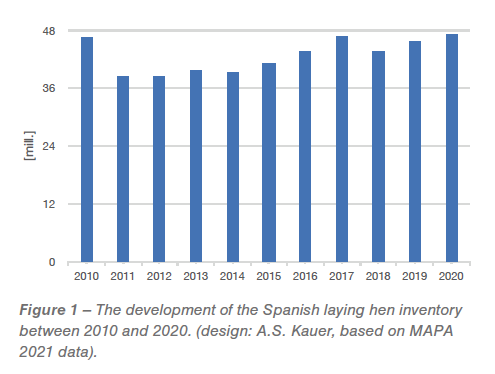

Determine 1 paperwork the lower of the variety of laying hens from 46.6 mill. birds in 2010 to 38.4 mill. in 2012, a results of the mandatory change within the housing techniques. In 2010, 81% of the hens have been nonetheless saved in typical cages and solely 14% in enriched cages. Within the following years, a stepwise transformation needed to be realised. In 2020, enriched cages have been the dominant housing system with a share of 78%. Barn and free-range techniques adopted with 13% respectively 8%. As in most Southern European international locations, natural techniques have been nonetheless solely of minor significance. The transformation of the housing techniques took six years and it was not earlier than 2020, after two years of a discount, that with a brand new most of 47.1 mill. hens, the stock of 2010 was surpassed (Determine 2).

Determine 1 paperwork the lower of the variety of laying hens from 46.6 mill. birds in 2010 to 38.4 mill. in 2012, a results of the mandatory change within the housing techniques. In 2010, 81% of the hens have been nonetheless saved in typical cages and solely 14% in enriched cages. Within the following years, a stepwise transformation needed to be realised. In 2020, enriched cages have been the dominant housing system with a share of 78%. Barn and free-range techniques adopted with 13% respectively 8%. As in most Southern European international locations, natural techniques have been nonetheless solely of minor significance. The transformation of the housing techniques took six years and it was not earlier than 2020, after two years of a discount, that with a brand new most of 47.1 mill. hens, the stock of 2010 was surpassed (Determine 2).

Dynamics in egg manufacturing displays change in housing techniques

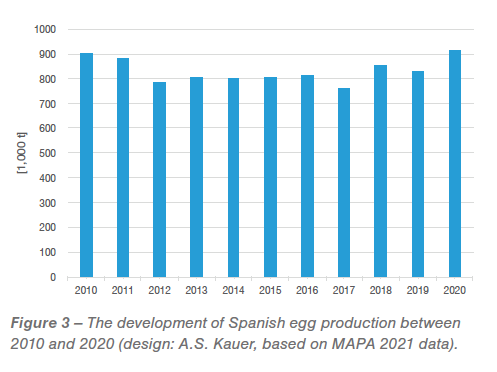

The transformation of the housing techniques with adjustments of the inventories resulted in a substantial dynamics in egg manufacturing (Desk 3, Determine 3).

The banning of typical cages from 2012 on led to a discount of egg farms from 1,755 in 2008 to 1,157 in 2012 and even 1,087 in 2013. Within the following years, farms with typical cages had both to be given up or remodeled to an alternate system. Fairly clearly, a substantial variety of egg farmers give up manufacturing. And even in 2010, their quantity was nonetheless 22.5% decrease than in 2008. In 2010, 1,466 egg farms produced 13.3 billion eggs, ten years later, 1,379 farms 15.1 billion. Desk 3 reveals that the manufacturing quantity with 918,000 t in 2020 was solely barely larger than in 2010. The common measurement of the farms elevated however the common egg weight decreased. This can be a results of comparatively younger flocks, because the stock grew from 45.8 mill. hens in 2019 to 47.1 mill. in 2020.

Nice variations within the regional focus of eggs farms and of egg manufacturing

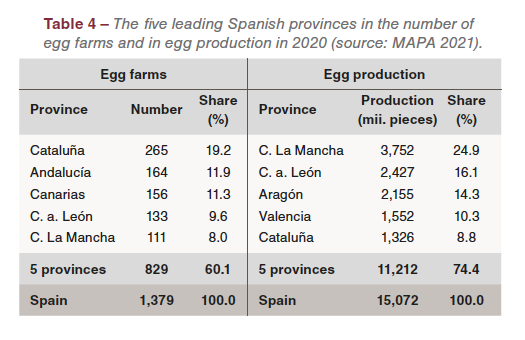

From the information in Desk 4 one can simply see that the regional focus within the variety of egg farms and in egg manufacturing differed significantly.

From the information in Desk 4 one can simply see that the regional focus within the variety of egg farms and in egg manufacturing differed significantly.

Whereas solely 8.0% of the Spanish egg farms have been positioned in Castile La Mancha, they shared 24.9% in egg manufacturing. Alternatively, 11.3% of the egg farms have been positioned on the Canary Islands, however they solely shared 2.4% in egg manufacturing. It’s apparent that the farms in Castile La Mancha have been a lot larger than within the different provinces and that with as share of collectively 41% the 2 Castile provinces are the centre of the Spanish egg trade.

Outstanding dynamics in Spanish egg commerce

Spain is likely one of the main egg and egg merchandise exporting international locations. In 2020, it ranked in fourth place with shell eggs for consumption exports and in third place with egg merchandise.

Together with hatching eggs and shell egg equivalents for egg merchandise, the general export quantity elevated from 144,300 t in 2010 to 266,300 in 2020 or by 84.5%. Determine 4 reveals the appreciable fluctuation through the transformation of the housing techniques. Imports reached their highest worth in 2017 with over 92,000 t and declined to solely 58,600 t in 2020.

Together with hatching eggs and shell egg equivalents for egg merchandise, the general export quantity elevated from 144,300 t in 2010 to 266,300 in 2020 or by 84.5%. Determine 4 reveals the appreciable fluctuation through the transformation of the housing techniques. Imports reached their highest worth in 2017 with over 92,000 t and declined to solely 58,600 t in 2020.

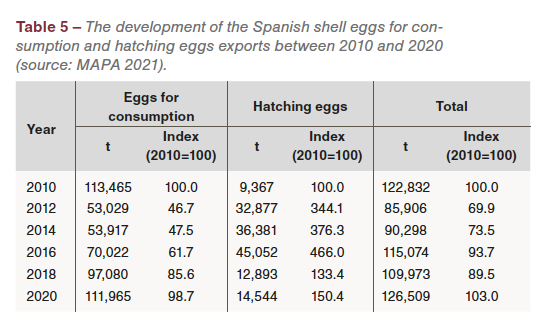

Throughout the transformation, exports of shell eggs for consumption declined quickly due to empty farms. To compensate for the financial losses, exports of hatching eggs gained in significance, as no chicks and pullets could possibly be positioned (Desk 5). As quickly because the transformation was accomplished and the farms have been stuffed once more, the exports of hatching eggs declined very quick, and eggs for consumption exports elevated. However, they have been nonetheless decrease than in 2010.

Throughout the transformation, exports of shell eggs for consumption declined quickly due to empty farms. To compensate for the financial losses, exports of hatching eggs gained in significance, as no chicks and pullets could possibly be positioned (Desk 5). As quickly because the transformation was accomplished and the farms have been stuffed once more, the exports of hatching eggs declined very quick, and eggs for consumption exports elevated. However, they have been nonetheless decrease than in 2010.

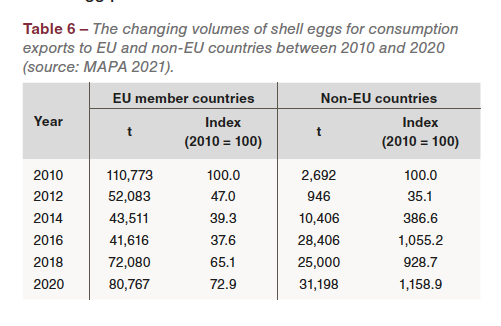

It’s value noting that through the transformation course of the commerce flows to EU member international locations and non-EU international locations modified significantly (Desk 6). In 2010, solely 2.4% of the eggs have been exported to non-EU international locations, in 2020 their share was 27.9%. Parallel to the rise of hatching egg exports, exports of egg merchandise additionally grew significantly, as eggs, which have been produced in typical cages through the transformation, might nonetheless be bought to the egg processors.

It’s value noting that through the transformation course of the commerce flows to EU member international locations and non-EU international locations modified significantly (Desk 6). In 2010, solely 2.4% of the eggs have been exported to non-EU international locations, in 2020 their share was 27.9%. Parallel to the rise of hatching egg exports, exports of egg merchandise additionally grew significantly, as eggs, which have been produced in typical cages through the transformation, might nonetheless be bought to the egg processors.

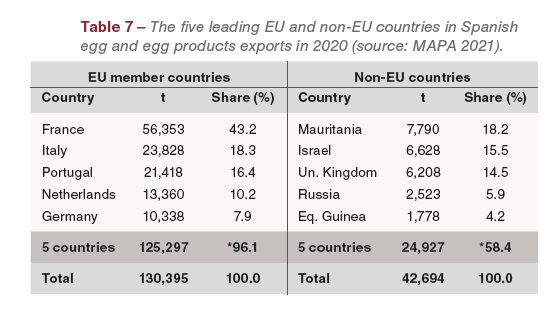

Exports to EU member international locations targeted on France, Italy and Portugal, with France in a dominating place with a share of 43.2%. The regional focus of exports to non-EU international locations was a lot decrease. The 5 main international locations solely shared 58.4% within the export quantity in distinction to 96.1% shared by the 5 main EU member international locations (Desk 7). It’s apparent that eggs have been exported to numerous non-EU international locations.

Exports to EU member international locations targeted on France, Italy and Portugal, with France in a dominating place with a share of 43.2%. The regional focus of exports to non-EU international locations was a lot decrease. The 5 main international locations solely shared 58.4% within the export quantity in distinction to 96.1% shared by the 5 main EU member international locations (Desk 7). It’s apparent that eggs have been exported to numerous non-EU international locations.

Egg imports have been solely of minor significance compared to exports. About 70% got here from France and Portugal. Hatching eggs have been primarily imported from Germany, the USA and the Netherlands.

A comparability of the share of eggs and egg merchandise within the exports to EU and non-EU international locations reveals some exceptional variations (Determine 5). In 2020, about 63% of the exports to EU member international locations have been shell eggs for consumption and 6% hatching eggs. Egg merchandise contributed 21%, of which 16 have been liquid entire eggs. In distinction, 73% of the exports to non-EU international locations have been shell eggs for consumption and 23% hatching eggs. Egg merchandise have been solely of minor significance. Right here, transportation distances have been the limiting issue.

A comparability of the share of eggs and egg merchandise within the exports to EU and non-EU international locations reveals some exceptional variations (Determine 5). In 2020, about 63% of the exports to EU member international locations have been shell eggs for consumption and 6% hatching eggs. Egg merchandise contributed 21%, of which 16 have been liquid entire eggs. In distinction, 73% of the exports to non-EU international locations have been shell eggs for consumption and 23% hatching eggs. Egg merchandise have been solely of minor significance. Right here, transportation distances have been the limiting issue.

Abstract and views

The previous evaluation confirmed that the transformation of the housing techniques for laying hens had far-reaching impacts on the Spanish laying hen stock, on egg manufacturing and egg exports. The banning of typical cages from 2012 on was a extreme problem for egg farmers as in 2010 nonetheless 81% of the hens have been saved in typical cages. The enforced transformation to different housing techniques not solely brought about a pointy discount of the laying hen stock but additionally of egg manufacturing. The export quantity of shell eggs for consumption decreased dramatically inside a couple of years. To compensate for the financial losses, extra hatching eggs and egg merchandise have been exported. Even in 2020, the amount of shell egg for consumption exports had not reached the worth of 2010 once more.  The sturdy fluctuation in egg manufacturing and egg exports brought about appreciable adjustments within the egg costs for the buyer and resulted in adjustments of the per capita consumption and the self-sufficiency fee (Determine 6). The Covid-19 pandemic and the lockdown brought about a pointy discount of vacationers and of the home egg demand. The lower might, nonetheless, be compensated by larger exports. With growing tourism and the next home demand, the export volumes of eggs and egg merchandise my decline on this and the subsequent 12 months.

The sturdy fluctuation in egg manufacturing and egg exports brought about appreciable adjustments within the egg costs for the buyer and resulted in adjustments of the per capita consumption and the self-sufficiency fee (Determine 6). The Covid-19 pandemic and the lockdown brought about a pointy discount of vacationers and of the home egg demand. The lower might, nonetheless, be compensated by larger exports. With growing tourism and the next home demand, the export volumes of eggs and egg merchandise my decline on this and the subsequent 12 months.

Knowledge sources

Beck, M.: MEG-Marktbilanz: Eier und Geflügel 2021. Bonn 2021.

Ministerio de Agricultura, Pesca y Alimentación (MAPA), Dirección Basic de Producciones y Mercados Agrarios (Ed.): El sector de la avicultura de puesta en cifras. Madrid, Junio 2021.